Bitcoin became the first of the many cryptocurrencies available today. Like digital gold, people can use Bitcoin to purchase items and services as if one had physical currency. Bitcoin and other cryptocurrencies operate around the traditional banking system.

What is Blockchain?

A Blockchain is a ledger that cannot be forged. Blockchains are becoming incredibly popular. But how do they function for what reason, and how can it add value to us? Blockchain is a term dubbed in 1991 by a group of researchers and was initially intended to put cryptographic timestamps as a notary for digital documents so that they can not be corrupted. Scott Stornetta and Stuart Haber developed the first Blockchain. By the following year, Haber and Stornetta, along with Bayer, combined Merkle trees to the design. It made the system more effective by requiring a block to obtain multiple document certificates. Each block in the Blockchain bears data encryption dispersed in multiple devices that simultaneously checks and validates any bit of information added. It’s almost resistant to any exploitation that a standard hacker would easily be able to do on a standard system. In 2008, a group called by the alias “Satoshi Nakamoto” modified Bitcoin’s code that the system started to gain momentum. By 2009, they published the whitepaper Bitcoin: A Peer to Peer Electronic Cash System that identified Bitcoin as a purely peer-to-peer form of digital currency. It was when blockchain technology became public and popular. Since then, it has become one of today’s leading breakthroughs in digital technology, making waves in different industries and business markets. By 2014, several analysts looked at Blockchain in a new perspective and saw that it could revolutionize many other industries, like the medical industry, education, government, businesses. It also brings cyber systems to a whole new level in the fight against cybercrime and data breach. Blockchain eliminates peer-to-peer (P2P) data collection and sharing intermediaries. It gives consumers direct access to data, unlike the internet that needs intermediaries or third parties. Indeed, Blockchain can protect consumers more than any web network can. It is why it is also dubbed as the new and safer internet. Blockchain’s key features make this possible:

Blockchain is decentralized.

Blockchain data is stored cryptographically.

Blockchain is democratised

Blockchain has no central authority, so knowledge is open to all on the network to see because it is a shared, unchangeable ledger.

Blockchain is immutable.

Manipulating data inside the Blockchain is nearly impossible. Both Blockchain networks or computer devices, typically numbering hundreds or thousands, would have to authorize all changes made simultaneously.

Blockchain is transparent.

All generated and stored data in a blockchain remains transparent. Everyone in the block is accountable for the data. All information in a blockchain is shareable. Blockchain can be used more than recording transactions. It can be used for a medical database and binding agreements. It is useful for monitoring delivery, tracing, and verifying the background and authenticity of items or contracts.

Blockchain Payment

People have started to accept this money exchange system because there are now many ways to pay with digital money. Now that we have more technology, we are moving toward a new way to move money – through blockchain payments.

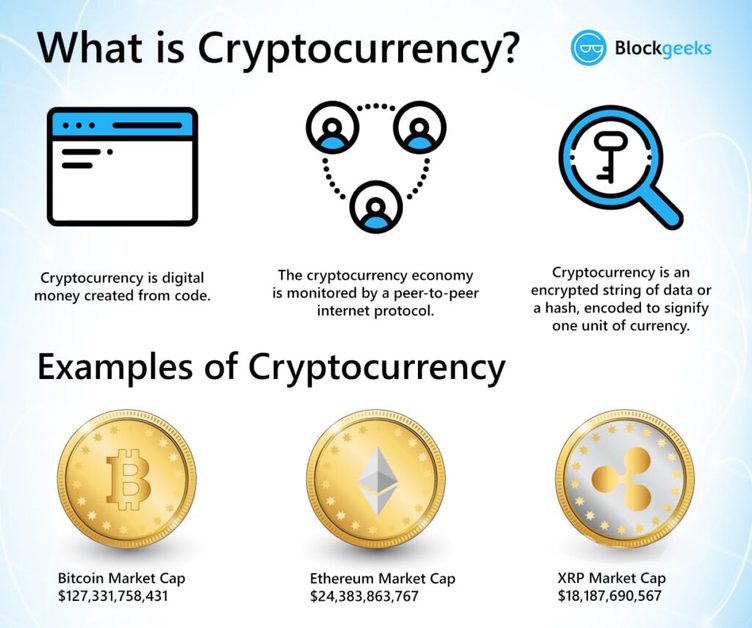

What is Cryptocurrency?

Cryptocurrency and blockchain technology is disruptive technologies because of its decentralized, peer-to-peer features. Each user in a blockchain has direct access to all data and is crucial to verifying new data and transactions added to the block. Hacking in Blockchain successfully means hacking every single device connected to the network, numbering hundreds to thousands at the same time, which is nearly impossible. Even if one succeeds in altering a block, it nullifies the entire block because each network is interconnected, bearing specific codes and keys, as well as digital signatures. The video below explains more about cryptocurrency. Cryptocurrencies’ advantages overshadow problems that beset any increasing technology. In fact, cryptocurrencies are on the rise today. It has become more popular due to the current pandemic that made touchless solutions a must. Aside from Bitcoin, there is Ethereum, XRP, and China’s DCEP (Digital Currency Electronic Payment). Facebook also launched Libra, its cryptocurrency. Ripple will soon be made public and will serve as a bridge currency for money transfers between borders. Cryptocurrency offers huge returns on your investment. Earnings from stock markets are also very viable. Stratis is currently doing well among ICOs (Initial Coin Offering), enjoying a 63,000 % increase in price from 2016. Spectrecoin also increased by more than 13,000 % from 2017. Cryptocurrency offers a huge ROI. Stock-market returns are also very viable. Stratis is currently doing well with ICOs, witnessing a price increase of 63,000 % from 2016. Spectrecoin also rose over 13,000 % from 2017.

Consumer Habits Are Changing

Increasingly, due to the global health crisis, customers are resorting to touchless business solutions and online payments. Yet the internet is not a safe environment. In fact, cyberattacks and fraud have increased during the pandemic. Cybersecurity is so crucial in keeping online transactions secure as can be. Cryptocurrency can provide that as it gives anonymity and security for consumers and retailers. It is the difference between cryptocurrency and your regular digital currency. When you make an online payment using digital currency like PayPal, you still need to have a bank account and the bank’s approval for every transaction. There is a service fee for transfers and other transactions. It is different with cryptocurrency. Consumers have complete control over the financial transactions they make like amounts charged or paid. Cryptocurrencies do not need bank authorization or reveal their information and location. This system also comes with some drawbacks, however, as these currencies are unpredictable, and their value fluctuates erratically anytime. This currency’s value can fluctuate beyond expectations, and the algorithm estimating its value is not always to be correct. Another drawback is based on the drastic changes that governments have made towards Cryptocurrencies. That caused losses in the past due to the fluctuating demands. Most people today have Cryptocurrencies but not enough opportunities to spend or invest them. It is still a vast market with tremendous ROI potential. By offering a payment option for Cryptocurrencies, businesses can discover new consumer markets.

Conclusion: Take a Good Kind of Risk with Blockchain-powered Cryptocurrency

If customers begin to see the security and convenience of being in full charge of their financial transactions, Cryptocurrencies will dominate, and online retailers and manufacturers would have an edge. It would lead to fewer security risks for the consumer, minus the third-party costs that beset users of digital currencies and conventional payment systems as consumers demand more trustworthy transactions in this digital economy. In any kind of technology and investment, risks will not be absent. There was a time when people were cautious of cloud computing when it was new, thinking physical servers are the perfect way to store data. But we know now that no server is immune to attacks. It is a standard procedure now to have cloud backup systems as well. Technological breakthroughs like smart technology, smart cars, and wearables have ushered businesses to the era of cloud-based services. So if there was any time to include cryptocurrency in your business, now is the time. Take a good kind of risk with blockchain-powered cryptocurrency while it is not yet flooded with competitors.